UIW Grad Floats New Idea to Change Old Money Lending Model

FloatMe App Attempts to Address Everyday Money Problems

San Antonio – When Josh Sanchez first crossed paths with the University of the Incarnate Word he had his sights set on a future in business. But when the path of his car crossed with a bus, the ensuing collision and needed repairs put his sights into new focus. Sanchez ended up taking out a small pay-day loan to pay for car repairs and was stunned by how much he had to pay in interest in just the two weeks it took him to pay back the loan.

San Antonio – When Josh Sanchez first crossed paths with the University of the Incarnate Word he had his sights set on a future in business. But when the path of his car crossed with a bus, the ensuing collision and needed repairs put his sights into new focus. Sanchez ended up taking out a small pay-day loan to pay for car repairs and was stunned by how much he had to pay in interest in just the two weeks it took him to pay back the loan.

“Seventy-eight percent of Americans live pay check to pay check,” says Sanchez. “One in two can’t afford to cover a $400 emergency expense. So, this is an everyday problem.”

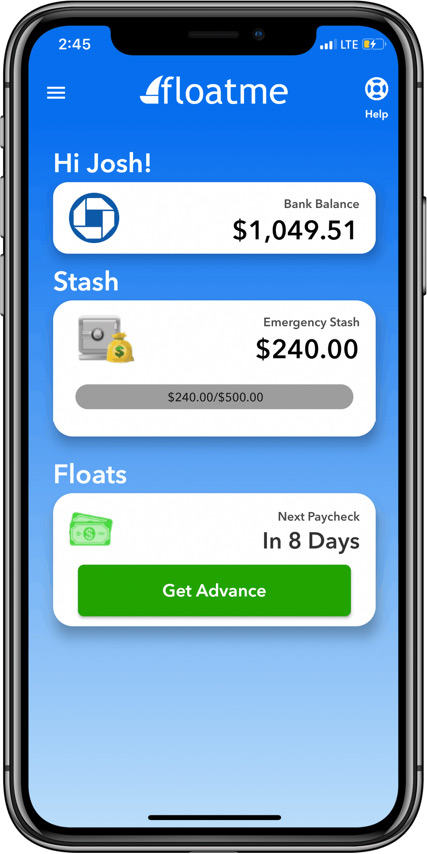

Convinced there had to be a better way, Sanchez, a 2016 graduate of UIW, teamed up with co-founders Ryan Cleary and Chris Brown, to develop an app called FloatMe. The app allows people to take out small, short-term advances on their paychecks at a low interest rate and without exorbitant fees. The app also has features that allow people to monitor their bank balances and help save money to avoid costly overdraft fees.

“You look at overdraft fees, that is another huge predatory practice,” says Sanchez. “In 2018, banks earned $36 billion in overdraft fees alone. It’s bothersome to think that a $2 cup of coffee can turn into a $36 cup of coffee in a matter of seconds. It was really eye opening to see the revenues being made from all of this. It’s expensive to be poor, really.”

Starting a new app is also a pricey proposition, as Sanchez quickly found out. While the app has already generated just over 3,000 users since its wide scale debut in August of 2019, it also has a waiting list of 70,000 and that has generated a buzz among investors. So far, the company has attracted roughly half-a-million dollars in pre-seed money and Sanchez hopes they will “open the floodgates” of users and raise more capital by mid-2020. The start-up has five full-time and two part-time employees and is already planning on expanding services to include a smart savings account with the ability to save for numerous goals like an emergency fund, vacations and gifts. All with an eye on keeping the everyday borrower secure from predatory lending.

Starting a new app is also a pricey proposition, as Sanchez quickly found out. While the app has already generated just over 3,000 users since its wide scale debut in August of 2019, it also has a waiting list of 70,000 and that has generated a buzz among investors. So far, the company has attracted roughly half-a-million dollars in pre-seed money and Sanchez hopes they will “open the floodgates” of users and raise more capital by mid-2020. The start-up has five full-time and two part-time employees and is already planning on expanding services to include a smart savings account with the ability to save for numerous goals like an emergency fund, vacations and gifts. All with an eye on keeping the everyday borrower secure from predatory lending.

“What is really rewarding is hearing the stories we get to be a part of,” says Sanchez. “We had a mom who used the app to cover the co-pay of her son needing to go see the doctor. Someone being able to get gas to go to work so they don’t get fired. It’s little things like that can really put someone in a financial set-back and we are in a position to help someone in need.”

Sanchez says the company is also in the exact position it wants to be in at this point… as in San Antonio. While many have pushed company leaders to relocate to either the West Coast or East Coast, they have decided to stay right here in what Sanchez considers to be a blossoming, high impact, high-tech environment for young entrepreneurs.

“I think opportunities exist everywhere. It really comes down to grit and dedication. It’s not easy starting something. The biggest thing for me was jumping blind. But I think what has really helped is surrounding yourself with the right people. That has really helped carry me forward and, I think, helped others too.”